When it comes to planning for what happens if you, or someone in your family dies, we tend think about the emotional and physical loss. What about the financial loss?

If the primary income earner passes away unexpectedly, how will their income be replaced? How will you cover the costs related to funeral, medical, or other expenses? Even the tragic loss of child could result in significant financial costs to the rest of the family. So, while you and your family are dealing with the loss of a person, the financial loss can be mitigated by the AMLA Life Insurance Policy.

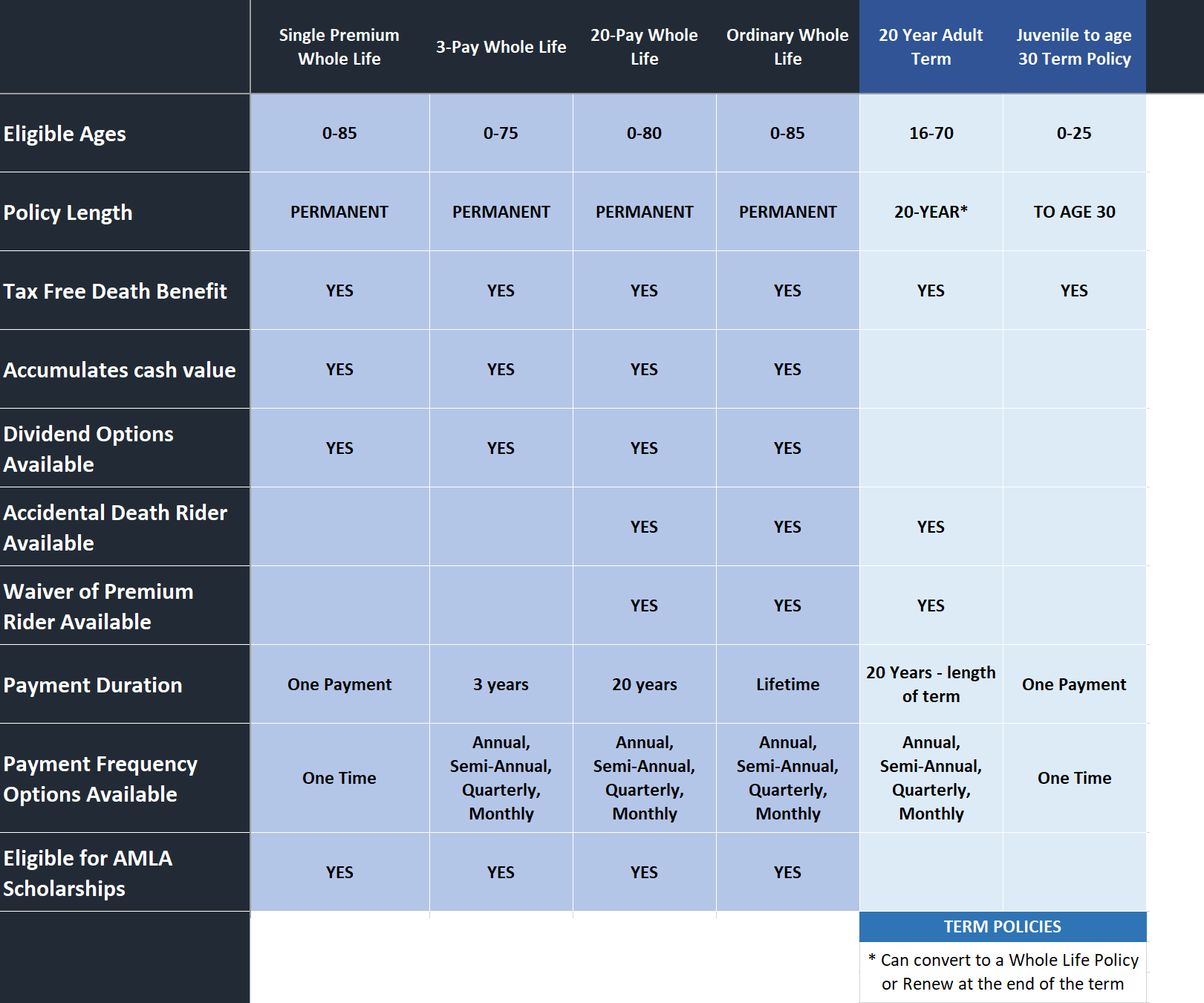

WHOLE LIFE POLICY-These are Life Insurance policies are guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. Because whole life policies are guaranteed to remain in force as long as the required premiums are paid, the premiums are typically much higher than those of term life insurance where the premium is fixed only for a limited term. Whole life premiums are fixed, based on the age of issue, and usually do not increase with age. You can choose between paying premiums until death, or limited pay policies which may be paid up with one payment, over 3 years or 20 years. Whole life insurance has a cash value throughout the life of the policy. These policies are eligible for dividends when offered. Accumulated dividends can be used to purchase paid up additional insurance, which can increase the benefit value of the policy over the life of the policy. Some restrictions apply. Contact an AMLA License Agent to find out all the details.

TERM LIFE INSURANCE This policy pays the full benefit amount if you pass away during the term of the policy – 20 years at the American Mutual Life Association (AMLA). Because the protection period is shorter than Whole Life, the premium is comparatively very low. However, term policies do not generally accumulate cash value and are not eligible for dividends. The American Mutual Life Association (AMLA) offers Conversion Credits at the end of a term that can be used to convert to another policy. At the end of the Term, Members also have the option to renew their Term Policy Annually. Some restrictions apply. Contact an AMLA License Agent to find out all the details.

The AMLA offers a range of benefit levels and premium payment schedules. Not sure which one is right for you? We are happy to quote you a price on multiple payment schedules so that you can pick the one that fits your budget. Contact the Home Office at 216-531-1900 (Monday through Friday, 8:30 AM to 5:00PM EST) or e-mail: Member@AmericanMutual.org.

How Much Do You Need?

This is a tough question. Everyone has different needs. Our Home Office has licensed agents who can help you find the right amount of insurance coverage. We also recommend that you use a Life Insurance Needs Calculator, available here to help you explore this question too.